Who is Cathie wood?

Cathie Wood is the founder, CEO, and CIO of ARK Investment Management, a thematic investment firm focused on disruptive innovation. She is also the host of The Disruptors, a podcast produced by ARK in partnership with Business Insider.

Wood has been investing in disruptive companies for over two decades. In 2014, she launched ARK with the goal of providing investors with access to the most disruptive companies in the world.

Today, ARK has over $50 billion in assets under management and is one of the fastest-growing asset managers in the world. Wood is a recognized expert on disruptive innovation and has been featured in The New York Times, The Wall Street Journal, Financial Times, and Barron’s. She’s also has been ranked by Barron’s as one of the “World’s 100 Most Influential Women in Finance” and by Forbes as one of the “Self-Made Women Billionaires.”

Why is Cathie wood famous?

Woods has been credited with correctly predicting the rise of several companies, including Tesla, Netflix, and Amazon. She has continually gone against the grains and this has worked in her favour with her fund outperforming most investment management firms.

Her fame comes from the fact that she’s been courageous enough to boldly make her predictions public in her podcast, media and interviews. You could say that’s pumping her own bags.

In 2020, she was named one of the “100 Most Influential People in Business” by Fortune magazine. So she’s definitely got the influence and she’s brilliant at leveraging this to her advantage.

Is Cathie Wood selling Tesla?

Wood has been a long-time advocate of Tesla and its mission to accelerate the world’s transition to sustainable energy. In 2020, she increased her stake in the company to over $1 billion.

Critics have accused Wood of being too optimistic about Tesla and its ability to meet its production targets. However, she continues to stand by the company and its prospects.

Cathie’s firm specializes in investing in disruptive companies. To date, her famous investments is in Tesla, Inc. (TSLA), an electric vehicle and renewable energy company (incase you’ve been living under a rock).

Wood has been a strong supporter of Tesla, and her firm has been one of the biggest investors in the company. In the past, she has sold some of her Tesla shares, but it’s not clear if she is currently selling any of her shares. It’s possible that she is holding onto her shares for the long term, or she may be selling some shares to take profits. Only Wood knows the answer to this question.

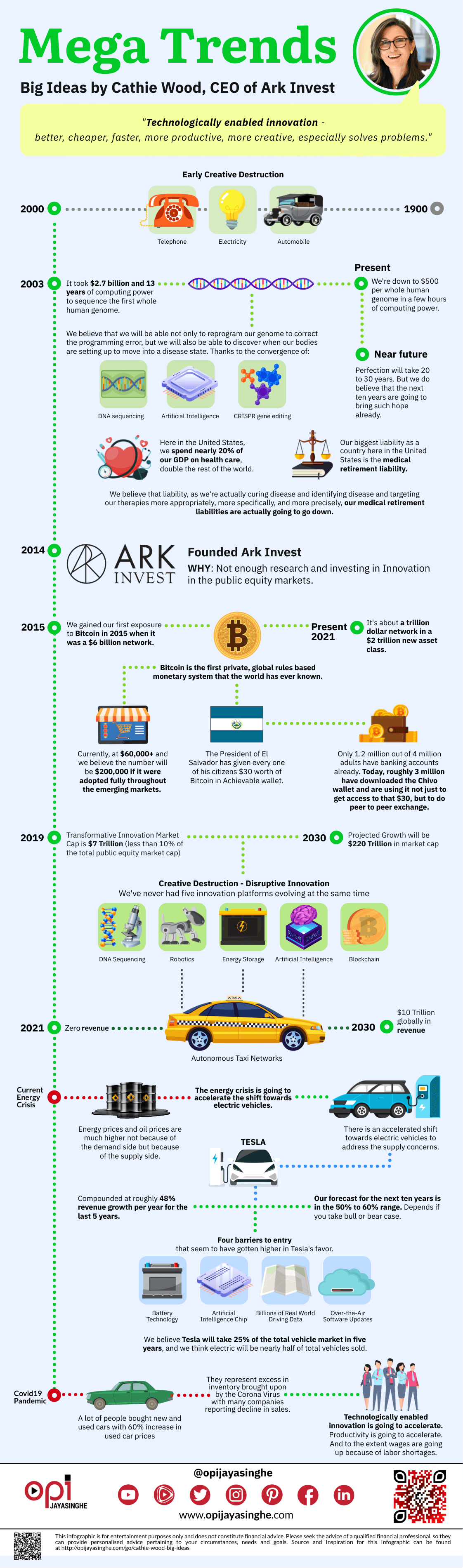

She goes into detail about how Tesla will completely take over this space. This is infographic which illustrates her views.

Download PDF

Is Cathie Wood a billionaire?

Yes, Cathie Wood is a billionaire. As of March 2021, her net worth is estimated to be $1.9 billion.

Wood has been a major force in the financial world, and her influence is only growing. She is a true visionary, and her ability to spot trends and invest in companies that are changing the world is unparalleled. She has made some incredibly successful investments over the years, and her track record speaks for itself.

There is no doubt that Cathie Wood is a billionaire. She is an incredibly successful investor, and her net worth is only going to continue to grow.

When did Cathie Wood first buy Tesla?

Cathie Wood first bought Tesla in May of 2013 when the stock was trading at $92 per share. She has been an early and vocal supporter of the company, and her firm has continued to buy Tesla shares even as the stock price has risen to well over $700 per share. In fact, Wood has said that she believes Tesla could ultimately be worth $4,000 per share.

Does Cathie Wood own Coinbase?

Yes, Cathie Wood’s first does owns Coinbase. She is also a member of the board of directors at Coinbase.

As of May 2021, Ark Invest owns 5.36% of Coinbase, making it one of the largest institutional investors in the company. Wood has been a vocal advocate of cryptocurrency and #blockchain technology, and her firm’s investment in Coinbase is a bet on the future of the digital economy. Coinbase is one of the leading exchanges for buying and selling cryptocurrencies, and its platform is used by millions of people around the world. With Ark Invest’s backing, Coinbase is well-positioned to continue its growth and play a major role in the future of digital finance.

Does Cathie wood own bitcoin

Cathie Wood has been a major advocate for bitcoin and blockchain technology. In an interview with CNBC, she stated that she owns bitcoin and believes that it is a “transformative technology.” Wood has been a driving force behind ARK’s investment in bitcoin, including its recent purchase of $1.5 million worth of the digital currency.

How to invest in Cathie Wood Ark?

Ark Invest is a cutting-edge investment firm that offers a suite of ETFs that target disruptive companies and industries. One of their most popular ETFs is the Cathie Wood Ark ETF, which invests in companies that are leading the way in innovation and disruption.

To invest in Cathie Wood Ark, you can buy shares of the company through a broker or online trading platform. You can also invest in Ark’s exchange-traded fund (ARKW) or mutual fund (ARKFX).

Disruptive innovation for growth (and volatility)

Disruptive innovation is a term used in business and technology to describe an innovation that changes the way an industry or market functions. The term was first coined by Harvard Business School professor Clayton M. Christensen in his 1997 book “The Innovator’s Dilemma.”

Christensen defined a disruptive innovation as one that brings a new product or service to market that is significantly different from what is currently available, and that ultimately displaces the existing market leader.

In recent years, the term has been applied to a wide range of businesses and technologies, from electric vehicles (Tesla) to online education (Zoom).

While disruptive innovation can lead to growth and new opportunities for businesses, it can also be a source of volatility for investors. For example, in February 2021, shares of Coinbase, a cryptocurrency exchange, fell sharply after Tesla announced it would no longer accept bitcoin as payment for its cars.

Ark Invest, an investment firm specializing in ETFs, has launched several “ARK” ETFs that focus on disruptive innovation. The firm’s founder, Cathie Wood, has said she believes the global economy will undergo a “massive reset” in the next five to 10 years as a result of disruptive innovations.

To Your Success,

Opi